1. Company Philosophy

The principles of Corporate Governance mainly deal with the way companies are led and managed, the role of the Board of Directors and the framework of internal controls. At Al Anwar Investments SAOG (AAI), the Board supports the highest standards of Corporate Governance. The Board of Directors is responsible for approving and monitoring the Company’s overall strategy and policies, including risk management policies, control systems, business plan and annual budget. The Management is responsible to provide the Board with appropriate and timely information to monitor and maintain effective control over strategic, financial, operational and compliance issues. The Board confirms that Al Anwar InvestmentsSAOGapplies the principles set out in the Capital Market Authority’s (CMA) Code of Corporate Governance for Public Listed Companies (the “Code”) and other rules and guidelines issued by the CMA from time to time.

We follow “International Financial Reporting Standards (IFRS)” in the preparation of accounts and financial statements.

2. Composition of the Board of Directors

During the year ended 31 March 2023, the Board consisted of seven directors who have varied backgrounds and experience and who individually and collectively exercise independent and objective judgement. The composition and the independence of the board of directors is in accordance with the Code.The members were elected to the Board at the Annual General Meeting held on 30 June 2021 for a term of 3 years. Board composition as on 31 March 2023 are as follow:

| Director | Position | Independent /Non-Independent |

| Brig. (Rtd.) Masoud Humaid Al Harthy | Chairman | Non-Independent |

| Dr. Shabir Moosa Al Yousef | Deputy Chairman | Non-Independent |

| Mr. Abdulredha Mustafa Sultan | Director | Independent |

| Mr. Qaboos Abdullah Al Khonji | Director | Non-Independent |

| Sheikh Mohamed Abdullah Al Rawas | Director | Independent |

| H.H.Fahar Bin Fatik Al Said | Director | Independent |

| Mr. Faisal Mohamed Al Yousef | Director | Non-Independent |

3. Board Meeting

The Board met six times during the year. The meetings were held on 21 April 2022, 29th May 2022, 7th August 2022, 14th November 2022, 6th February 2023 and 21st March 2023.

| Sr. | Name of the Director | Position | AGM | Number of meetings attended | Number of Directorship in other listed companies | ||

| Held on | Board | NREC | AC | ||||

| 23-06-2022 | |||||||

| 1 | Brig. (Rtd.) Masoud Humaid Al Harthy | Chairman | Present | 6 | – | – | 1 |

| 2 | Dr. Shabir Moosa Al Yousef | Dy. Chairman & Chairman NREC | Present | 6 | 8 | – | 3 |

| 3 | Mr. Abdulredha Mustafa Sultan | Director & Chairman AC | Present | 6 | – | 4 | 1 |

| 4 | Mr. Qaboos Abdullah Al Khonji | Director & NREC Member | Present | 6 | 8 | – | 3 |

| 5 | Sheikh Mohamed Abdullah Al Rawas | Director & NREC Member | Present | 5 | 6 | – | 1 |

| 6 | H.H. Fahar Bin Fatik Al Said | Director & AC Member | Present | 6 | – | 4 | 1 |

| 7 | Mr. Faisal Mohamed Al Yousef | Director and AC Member | Present | 6 | – | 4 | 3 |

The Meeting attendance fees paid to the members for each meeting attended is as follows:

Chairman – OMR 2,000, Deputy Chairman – OMR 1,600, Other Members – OMR 1,500

4. Board Committees:

Nomination, Remuneration & Executive Committee (NR&EC)

NR & EC is a sub-committee of the Board consisting of the following three directors:

Dr. Shabir Moosa Al Yousef Chairman

Mr. Qaboos Abdullah Al Khonji Member

Sheikh Mohamed Abdullah Al Rawas Member

The NR&EC is delegated powers and authority to facilitate the smooth running of the operations of the Company and exercise all the responsibilities of the Board which are beyond the authority of the management and within the limits set out in the Manual of Authority approved by the Board. The Committee also assist the general meeting in the nomination of proficient directors and the election of the fit for the purpose, assist the Board in selecting the appropriate and necessary executives, provide succession planning for the executive management and Board chairman and fixing the appropriate remuneration and incentives for the executive management.

The NR&EC is governed by the terms of reference (Charter) approved by the Board. The working plan of the committee is approved by the Board every year.

The NR&EC met eighttimes during the year on 14April2022, 29May 2022, 27 June 2022,7August2022, 14September & 2 October2022, 13Nov2022, 6 February 2023 and 21 March 2023.

The Meeting attendance fees paid to the members for each meeting attended was OMR 650 for Chairman and OMR 550 for Members as approved by AGM.

Audit Committee

The Audit Committee (AC) is a sub-committee of the Board, comprising of the following three non-executive directors, who are appointed by Board:

Mr. Abdulredha Mustafa Sultan Chairman

H.H. Fahar Bin Fatik Al Said Member

Mr. Faisal Mohamed Al Yousef Member

The Audit Committee is constituted in accordance with the provision of the Regulation for Public Joint Stock Companies issued by CMA. Audit Committee Chairman is an Independent Director and majority of the members are Independent Directors.

All the members are experienced and have sound knowledge of risk management, governance, finance and accounting. The terms of reference (Charter) of the Audit Committee are in accordance with the Regulation for Public Joint Stock Companies issued by CMA. The working plan of the committee is approved by the Board every year.

Major areas covered by the Audit Committee are matters concerning:

- Consideration and recommendations for appointment of Internal and External Auditors,

- Reviewing of audit plans and audit reports.3

- Oversight of internal audit functions to comply with all the requirements of internal audit as per Regulation for Public Joint Stock Companies issued by CMA;

- Oversight of adequacy of internal control systems and financial statements;

- Ensuring adequate procedures are in place to detect and prevent any cases of financial fraud or forgery;

- Checking financial frauds;

- Reviewing annual and quarterly financial statements and qualifications, if any, before issuing;

- Critical review of non-compliance of IFRS and disclosure requirements prescribed by CMA;

- Reviewing risk management policies and related party transactions;

- Serving a channel between internal and external auditors and the Board.

The Meeting attendance fees paid to the members for each meeting attended was OMR 650 for Chairman and OMR 550 for Members as approved by AGM.

5. Brief Profile of the Directors

Brig. (Rtd.) Masoud HumaidAl Harthy

He is a retired brigadier from the Royal Guard of Oman.Brig. (Rtd.) Masoud holds a Bachelor’s Certificate in Army Science Management with an experience of 37 years in military services. Brig. (Rtd.) Masoud is Chairman of Al Maha Ceramics SAOG in addition to being a Board member in several other Companies.

Dr. Shabir Moosa Al Yousef

He holds PhD and Master of Research in Economics from University of Essex (UK), MBA in Finance from University of Lincolnshire & Humberside (UK), Master of Science from Colorado School of Mines (U.S.A), and Bachelor’s Degree in Electronics and Communications from Sultan Qaboos University.

Previously, he held many senior positions such as Chief Executive Officer of Oman Investment & Finance Co. SAOG, General Manager of Damac Holding in U.A.E, Group General Manager Truck Oman LLC, and a Petroleum Engineer post in Petroleum Development Oman (PDO).

He is currently the Vice Chairman of the Board of Al Anwar Investments SAOG, the Vice Chairman of Arabia Falcon Insurance Company SAOG, the Vice Chairman of Al Maha Ceramics SAOG, the Vice Chairman of Oman Chlorine SAOG, and a Board member in Cactus Premier Excavation Services Company SAOC. He is also a member of General Secretaire of the Tender Board

During his career, he was also a Board member of Bank Sohar SAOG, Financial Corporation Co. SAOG, and Chairman of National Aluminum Products Company SAOG.

Mr Abdulredha Mustafa Sultan

He holds a Bachelor Degree in Commerce majoring in Finance from San Diego State University, USA. He is Deputy Chairman of Al Jazeera Services Co. SAOG, and Board member of Fisheries Development Oman SAOC (FDO)and Almondz Global Securities Limited (India). He is Managing Director in Mustafa Sultan Enterprises LLC. He is a member of the Young Presidents’ Organization. He is also the Honorary Consul of Finland in Oman.

Mr. Qaboos Abdullah Al Khonji

Mr. Qaboos Al Khonji holds a Bachelor’s degree in Business Administration from U.S. He is the Deputy Chairman of Al Khonji Invest LLC (Formerly known as Al Khonji Holding LLC) and Chairman of Al Binaa Constructions & Industry SAOC. Apart from these he is Deputy Chairman for Al Khonji Real Estate Development SAOC. He also holds Directorship in some of the prominent SAOG / SAOC Companies in Oman including The Financial Corporation Co. SAOG (FINCORP), Al Anwar Investment SAOG, Oman Chlorine SAOG, Oman Hotels & Tourism Co. SAOC, Desert Night Resort SAOC and Al Sharqiya Hotels & Tourism Co. SAOC, Al Anwar Hospitality SAOC, Al Anwar Industrial SAOC. He has an extensive experience in the Construction and Retail and Hotel business. Mr. Qaboos belongs to a traditional business dominated family and also holds Directorship at Al Khonji Group LLC. He is Deputy Chairman of the Investor’s Committee at FINCORP Al Amal Fund. He has previously held a position of General Manager in Moosa Abdul Rahman Hassan & Co. (2000 – 2002) and was the member of Board at the various companies like Tageer Finance Co. SAOG (2008 -2014) & Al Maha Ceramics Co. SAOG (2010-2023). He also has held Deputy Chairman’s position at OIFC SAOG (2008-2014).

Sheikh Mohamed Abdullah Al Rawas

Holds an honorary doctorate in business administration from Luton University in 2005 as the first person in Asia and the Middle East to obtain that doctorate from this prestigious University for his efforts in the higher education sector in the Sultanate of Oman during his presidency of the board of directors of Majan University College. He also holds a Bachelor’s degree in Business Administration, majoring in Finance and Investment, from Cairo University. He is currently a member of Al Anwar Investments SAOG and Dhofar Cattle Feed Co. SAOG.

He was previously held position of Board member in Oman Aviation Services Company SAOC, Oman and Emirates Investment Holding Company SAOG, Vice Chairman of the Board of Directors of Raysut Cement Company SAOG, member of the Board of Directors of the Oman Chamber of Commerce and Industry and representative of the Chamber in the Union of Arab Banks represented the Chamber in the ESCWA meetings in Beirut, Chairman of the Banking and Investment Committee in the Chamber, Member of the Temporary Committee for Economic Diversity in the Central Bank of Oman, member of the Board of Directors Literacy& Ministry of Education, Vice Chairman of the Board of Directors of the Gulf Plastic Company and a member of the Board of Directors of Global Computer services LLC (Globcom).

He is also a partner and member of the board of directors of Al Rawas Holding Group and a shareholder partner in Oman Treasures Holding Company.

H.H. Fahar Bin Fatik Al Said

Holds a Bachelor’s degree in Business Administration from Anglia Ruskin University in the United Kingdom.He also holds a Diploma in International Business Administration from the London School of Business and Finance. H.H is currently Director of the Branch Affairs Department in State Audit Institution of Sultanate of Oman, Chairman of the Board of Directors of Fahar Bin Fatik LLC, Vice Chairman of the Board of Directors of Fatik Bin Fahar Group companies, Honorary chairman of Oman food Bank(DAYMA) and Board member of Ubar Hotels & Resorts SAOG (Oman).

Mr. Faisal Mohamed Al Yousef

Faisal Al Yousef is the CEO of Al Yousef Group LLC (AYG). He rejoined the group after working with Ernst & Young (Chartered Accountants) in Oman and the UAE as an Audit specialist. He is a Fellow of Chartered Certified Accountant (ACCA, UK) and also holds an Executive MBA from Oxford university (Said Business School) a BSc in Economics from SOAS (University of London), UK. He also holds an Advance Diploma in insurance from the Bahrain Institute of Banking and Finance. Faisal Al Yousef represents AYG on the boards of various investee companies, including Chairman of Muscat Finance, Deputy Chairman in Al Ruwad International for Education Services and Cactus Premier Drilling Services and a Board member of Dhofar International Development and Investment Company, Bank Dhofar, and Al Anwar Investments. He is also the Executive Director of Muscat Electronics. Throughout Faisal Al Yousef’s career he was involved with at least two green field projects. These are today listed on the Muscat Stock Exchange. Faisal Al Yousef brings with him two decades of experience in banking and finance and insurance and investments.

Faisal is also involved with a number of voluntary works including the Oman Tennis Association and Board of Governors of the Government Schools in Muttrah.”

6.Board Evaluation

The Code requires that the Board of Directors performance is appraised impartially and independently by a third party appointed by the AGM in accordance with a benchmark and standards set by the Board or the general meeting. The AGM held on 23rd June 2023 approved the appointment of an independent third-party, Baker Tilly MKM (Oman) LLC, as per the evaluation framework parameters. The appointed consultants carried out the evaluation exercise during the year and presented a report with recommendations and concluded that “the Board as a whole has resulted in a Very Satisfactory score for the year 2022-2023”.

7. Process of nomination of the Directors

The company follows the provisions of the Commercial Companies Law and Capital Market Authority Law & Regulations in respect of nomination of the members of the Board of Directors.

8. Management

The members of the management of the company are appointed with proper contracts clearly defining the terms of reference.

9. Brief profile of top management personnel with executive powers

Khalid Abdullah Al Eisri, Chief Executive Officer

He is Chartered Financial Analyst (CFA) and holds a Bachelor’s degree in Finance from Sultan Qaboos University. Hehas more than 17years of experience in investment management and corporate advisory. Prior to joining Al Anwar Investments, he held the position of Acting Senior Manager at the Oman Investment Authority.

Mr. Khalid is a director in National Biscuit Industries Ltd SAOG, National Detergent Co SAOG, Voltamp Energy SAOG, and Al Ruwad International for Education Services SAOC. He also held directorship in several companies such as RAK Ceramics, Al Hosn Investment Company, Oman Growth Fund, Oman & Emirates Investment Holding Company, Ubar Capital, United Finance and Gulf Mushroom Production Company.

Dhiraj Chidwal, Manager – Internal Audit & Risk Management, Board Secretary

Dhiraj Chidwal is a Chartered Accountant with accreditations from the Institute of Chartered Accountants of India and Certified Public Accountant (CPA) from USA. He has more than twenty years of experience in the field of Internal Audit, Finance and Accounting. Prior to Al Anwar, he worked for one of leading private bank in India as Chief Manager, Internal Audit. He has extensive experience in the Internal Audit of Banking and Finance sector.

Mubarak Al Ghazali,Manager – Administration & Compliance

Has more than 28 years of experience in insurance, management, HR, administration and Governance and compliance. Holds General Diploma certificate and a certificate in Human Resource Management. He Attended several training courses, workshops and conferences in various fields like Governance and compliance, Human Resource, Executive Management skills and Effective Leadership. Also attended many conferences and seminars organized by Muscat Stock Exchange Securities Market and Capital Market Authority, Omani Securities Association, Oman Centre for Governance and Sustainability and other government and private bodies. Held directorship in Al Anwar Industrial Investments SAOC and Al Anwar Hospitality SAOC. He also has extensive experience in establishing companies in all their legal forms.

Ahmed Ibrahim, Assistant Finance Manager

Ahmed Ibrahim is an MBA in Financial Markets from Institute for Market Studies (IEB Spain), and a Bachelor of Commerce from Zaqaziq University (Egypt). He has more than 21 years of experience in different fields including banking, advertising, detergent manufacturing, and Investment company. His core expertise is in monitoring and managing the Financial and Treasury operations of the company.

10. Means of communication with the Shareholders and investors

- The notice to the Shareholders for the Annual General Meeting containing the details of the related party transactions is filed with CMA and mailed to shareholders along with Directors’ Report and audited accounts.

- The Quarterly results of the company as per CMA format, are prepared by the management for every quarter, reviewed by the Audit Committee, approved by the Board, are forwarded to CMA and also published in the Newspapers as per the directives of CMA. Copies are made available to shareholders on request. Results are also uploaded on the website of Muscat Stock Exchange (MSX).

- Pursuant to the Executive Regulations of the Capital Market Law, Al Anwar has disclosed the initial quarterly and annual un-audited management results within 15 days from the end of the period.

- Important Board decisions are disclosed to the investors through MSX from time to time. The company has its official website, alanwar.om for its investors. The website is updated from time to time.

- The Management Discussion and Analysis Report forms part of the Annual Report.

11. Remuneration matters

- The meeting attendance fee was paid as approved by shareholders in AGM held on 23 June 2022. A total of OMR70,000(FY 2021-22: OMR75,850/-) was paid to Directors for meetings attended during the period 1 April 2022to 31 March2023.

- A sum of OMRNIL (FY 2021-22: NIL) was reimbursed to Directors towards travelling expenses for attending the meetings in addition to above mentioned sitting fees.

- The remuneration for the employees is, after critical evaluation, fixed by the Board, based on the qualification, expertise and efficiency of the executives. The total remuneration of the to four employees for financial Year 2022-23 was OMR193,195(The top four forFY 2021-22: OMR138,843).

- The Board recommend Directors’ remuneration of OMR 64,500 for the year 2022-2023. (FY 2021-2022: OMRNIL).

12. Details of non-compliance by the company

No penalties have been imposed by CMA or MSX or any other statutory bodies on the company during the year 2022-23.

13. Market price data

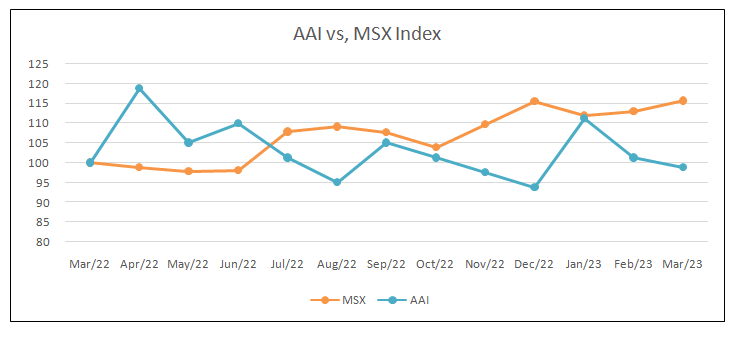

The performance of the Company’s share price during the financial year ended 31 March 2023 against MSX Index is shown below:

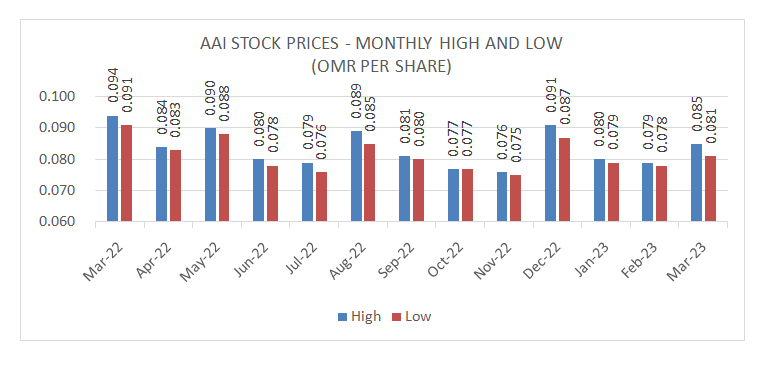

The monthly high and low share price of the company during the financial year ended 31st March 2023 was as under:

14. Distribution of Shares

14. Distribution of Shares

The shareholding pattern as on 31 March 2022 is as given below:

| Distribution | No of Shareholders | % of Shareholders | No of Shares | %of No. of Shares | |

| 1 to 50,000 | 1484 | 85% | 12,339,436 | 6% | |

| 50,001 to 100,000 | 96 | 5% | 7,234,217 | 4% | |

| 100,001 to 200,000 | 74 | 4% | 10,868,503 | 5% | |

| 200,001 to 500,000 | 55 | 3% | 16,554,318 | 8% | |

| 500,001 & Above | 42 | 2% | 153,003,526 | 77% | |

| Grand Total | 1,751 | 100% | 200,000,000 | 100% |

The Company does not have any foreign Global Depository Receipts (GDR) / American Depository Receipts (ADR) / Warrants or any other instrument of any type issued to public or institutional investors or any other class of investors.

15. Corporate Social Responsibility (CSR)

Al Anwar Investments SAOG is committed to support the society and environment. During the year, company has contributed OMR 10,000.

16. Professional profile of the statutory auditor

BDO LLC, the statutory auditors of the Company, have been operating in the Sultanate of Oman since 1976. BDO LLC is an independent and legally distinct member firm of BDO International Limited. BDO, one of the leading professional services firm, providing industry-focused Assurance, Tax and Advisory services, has over 97,000 employees working in a global network of 1,728 offices situated in 167 countries and territories.

BDO LLC is accredited by the Capital Market Authority to audit publicly listed joint stock companies (SAOGs) in Oman. The fees for auditing the financial statements for the year ended March 31, 2022, and the report on compliance with the corporate governance law amounted to OMR 8,000.

17. Specific areas of non-compliance with the provisions of corporate governance and reasons

This report is prepared in compliance with the Code of Corporate Governance and covers all the items specified in Annexures 3 of code of Corporate Governance issued in July, 2015 and updated in December 2016.

18. Acknowledgement by Board of Directors

The Board of Directors is responsible for the preparation of the financial statements in accordance with the applicable standards and rules.

There are no material things that affect the continuation of the Company and its ability to continue its operations during the next financial year.

The Board of Directors, through the Audit Committee’s consideration of the results of the internal audit work and discussions with the external auditors, together with their examination of periodic management information and discussions with the management, have reviewed the operation of internal controls during the year ended 31 March 2023. The Board of Directors has concluded based on this those internal controls operated effectively throughout the year.

For Al Anwar Investments SAOG

Masoud Humaid Al Harthy Sultan Abdulredha Mustafa

Chairman Chairman Audit Committee